Binance Research has released an institutional-grade report on JP Morgan Coin’s potential impact on the world of finance and cryptocurrency. Overall, Binance says the coin could be viewed as a stepping stone for mass adoption of cryptocurrency, noting that a truly decentralized economy that thrives on open-source distributed ledgers like Bitcoin, Ethereum and XRP won’t materialize overnight.

“Should this pilot project prove successful as a model for driving institutional adoption of private blockchains, it may be an intermediate stepping stone for crypto mass adoption as clients move toward private distributed ledgers backed by technology providers of enterprise whitelabel solutions; however, a global decentralized economy will not appear overnight with everyone running on public blockchains.”

Due to the sheer size and power of JP Morgan, Binance says the bank’s new coin is not to be ignored.

“JPM Coin has the potential to dramatically impact both existing financial institutions as well as the broader cryptoasset market given the size of its balance sheet, industry influence, and extensive global network of partners…

Bitcoin was created to allow ‘online payments to be sent directly from one party to another without going through a financial institution.’ Ten years later, the landscape of the cryptocurrency industry has undoubtedly changed dramatically and financial institutions have become one of the key prominent players in the future of blockchain – be it private or public.”

The report points to stablecoins as the sector of the crypto market that will most likely be impacted by the new coin.

“Broadly speaking, JP Morgan’s stablecoin project will initially target efficiency gains and risk reduction in clearing and settlement functions, as well as cost reductions across core back office functions.

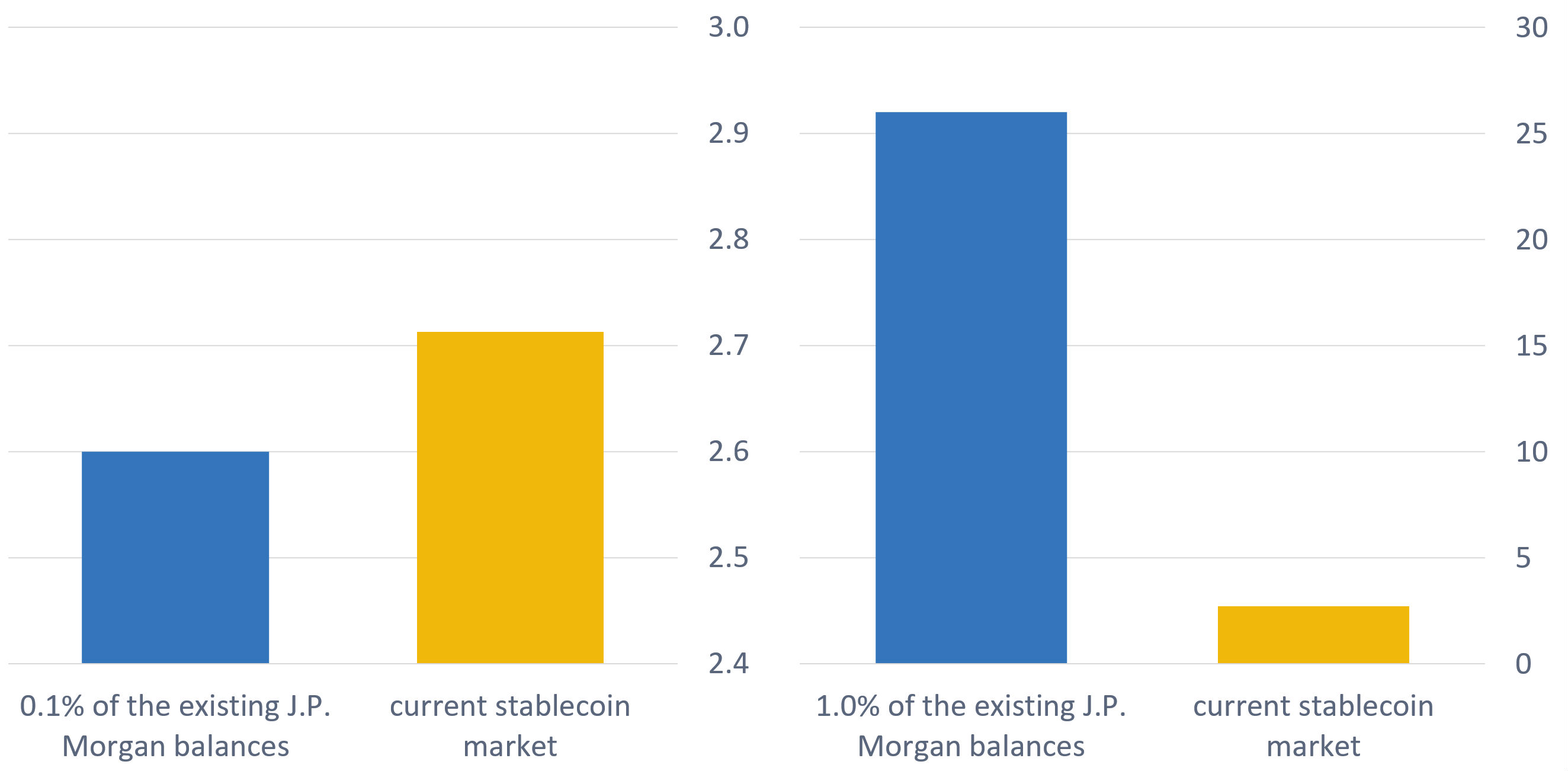

Based on JP Morgan’s position as one of the world’s largest banks, even a small portion of total assets locked as fiat collateral for JPM Coin could make the institution the largest stablecoin issuer on a blockchain measured by circulating supply and total market cap. For an illustration of the potential size of JPM Coin circulating supply, two scenarios were established to put in perspective the size of JP Morgan’s balance sheet (USD2.6 trillion) with the size of the existing stablecoin markets.”

JP Morgan’s Balance Sheet vs. Stablecoins

The report also specifically analyzes the impact JP Morgan Coin could have on Ripple/XRP, concluding the two projects “appear to have different focuses” in the short term.

“Looking back at the Ripple ecosystem and the xRapid infrastructure, XRP works in a similar manner as USD in the traditional financial system: it acts as the mediator currency between both fiat / crypto currencies and any fiduciary product (e.g. commodity, points, miles, etc.). This allows various closed system networks (such as JPM Coin) to interact with each other, with XRP acting as a bridge between these networks.

Overall, the two projects appear to have different focuses and potential applications in the short term. While there is currently no direct overlap on the functionality of the two initiatives, future developments on the reach of JPM Coin outside of its existing closed network will determine to what degree Ripple and JPM Coin will compete.”

You can check out the full report here.

[the_ad id="42537"] [the_ad id="42536"]