Messari, a crypto economics data research platform for investors, regulators and the public, has launched a new exchange volume tracker using data from a limited number of exchanges. Now live on the OnChainFX dashboard, the ‘Real 10 Volumes’ option tracks Bitcoin and crypto trading volume using data from Binance, Bitfinex, Bitflyer, Bitstamp, Bittrex, Coinbase Pro, Gemini, itBit, Kraken and Poloniex.

According to the announcement,

“‘Real 10’ refers to the ten exchanges we believe have reported significant and legitimate crypto trading volumes via their APIs… Our price methodology already accounted for apparent volume discrepancies between these exchanges and other components, but we’re now limiting our default volume calculations to ‘Real 10’ exchanges on OnChainFX, similar to findings from Bitwise Investments.”

Bitwise Investments just disclosed research indicating that 95% of crypto exchange volume is fake. It cited industry leader CoinMarketCap (CMC) as reporting wrong data.

In a recent filing with the US Securities and Exchange Commission on behalf of its pending Bitcoin ETF proposal, Bitwise released its findings and concluded that “the real market for bitcoin is significantly smaller, more orderly, and more regulated than commonly understood.”

Nine of the top 10 exchanges by trading volume listed on CMC are excluded from Messari’s feed: Bit-Z, BW.com, OKEx, Coineal, Huobi Global, BitMart, DigiFinex, BitForex and Bibox. Leading crypto exchange Binance is the sole exception.

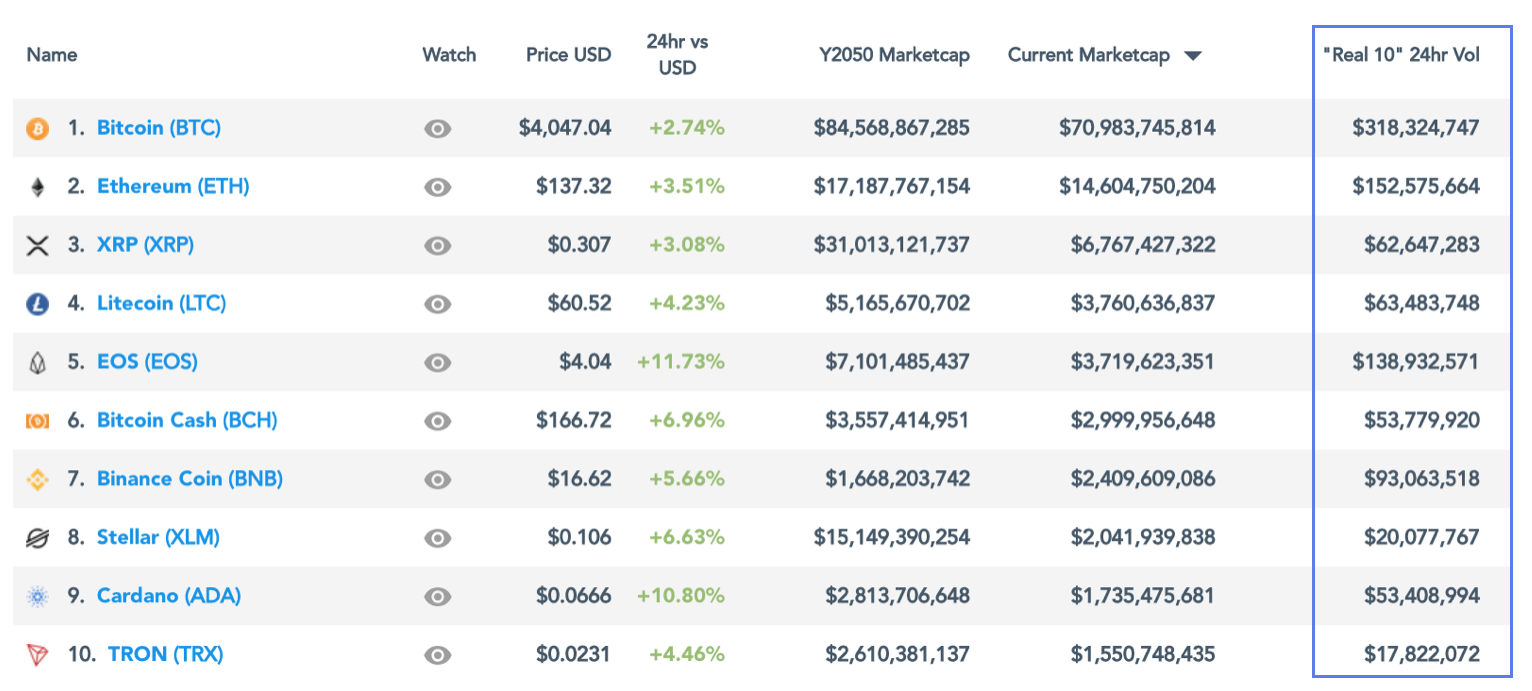

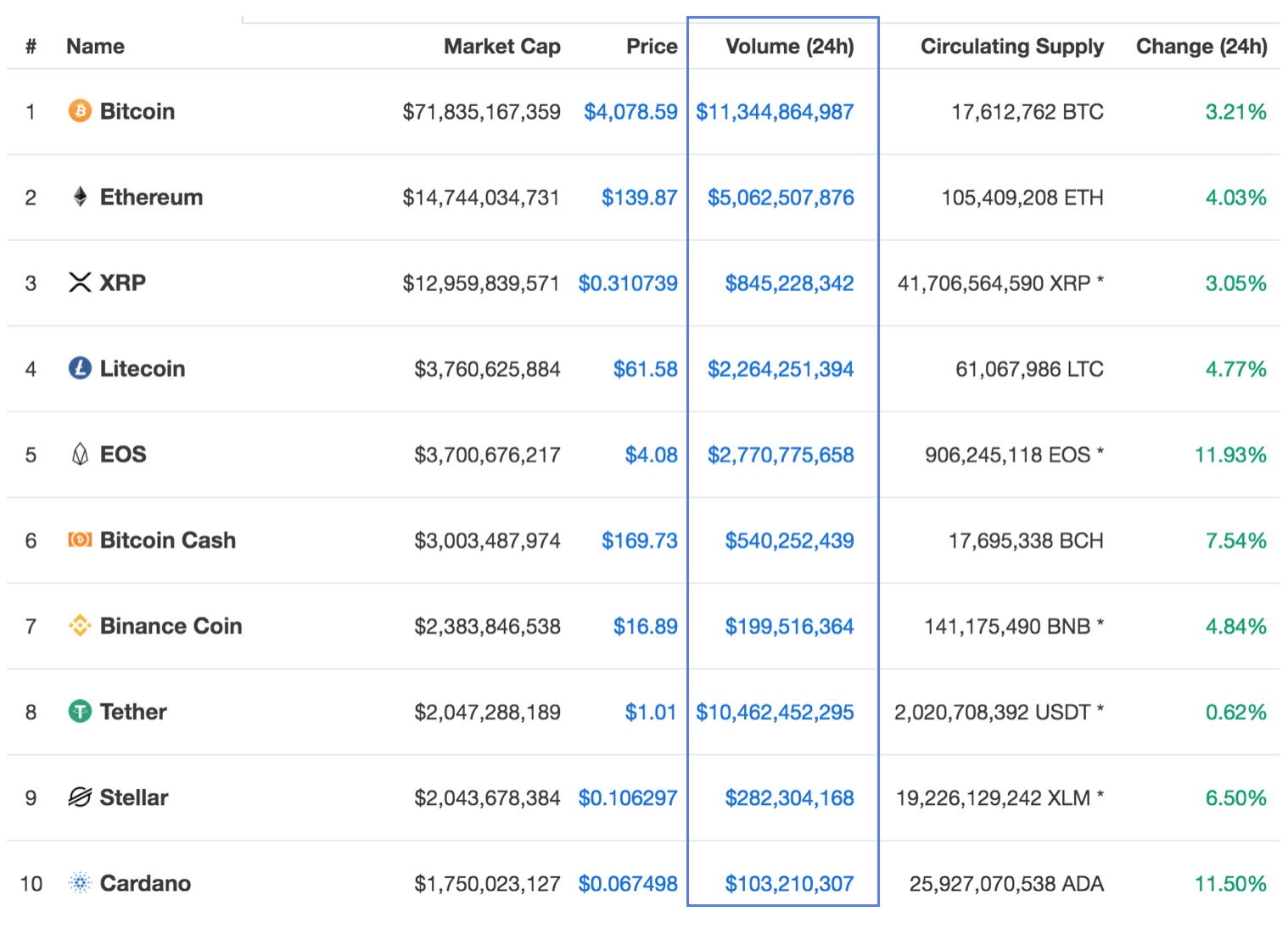

At time of writing, Messari shows 24-hour trading volume for Bitcoin at $318.3 million, up 11.33% from $285.9 million in the past five hours. CoinMarketCap reports 24-hour trading volume for Bitcoin at $11.34 billion, up .44% from $11.29 billion for the same time period.

Messari’s Real 10 24-Hour Trading Volumes

CoinMarketCap 24-Hour Trading Volumes

In the coming months, Messari plans to add more exchanges that generate clean order book data in order to accurately reflect the crypto market data.

[the_ad id="42537"] [the_ad id="42536"]